Skip-a-Pay

Life can sometimes throw unexpected expenses at you, leaving you feeling financially strapped.

If you have been making regular payments on an eligible loan, you may be able to skip an upcoming payment for a nominal fee with our Skip-a-Pay service.

Service Details

Skip-a-Pay can be done at your convenience through Online Banking and the APFCU Mobile App. If you do not have Online Banking, enroll here or visit a nearby branch for assistance.

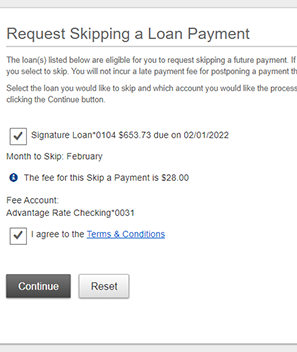

You can skip one monthly loan payment per twelve-month period and a maximum of six (6) total skips within your loan period. For each skipped payment, a $28 processing fee will be deducted from your selected Savings or Checking account.

To be eligible for this service:

- Your eligible loan(s) should be open for at least six (6) months;

- All accounts including other loans at our credit union must be current and in good standing;

- Your address on file is current.

After you have successfully skipped a payment, your next payment will be due by the following month’s regularly scheduled due date. Additionally, interest will continue to accrue during the skipped period and your original maturity date will be extended.

Skip a payment through Online Banking

Step One

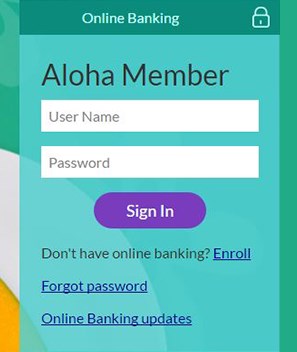

Log into Online Banking

using a desktop or laptop computer from our home page, alohapacific.com.

Step Two

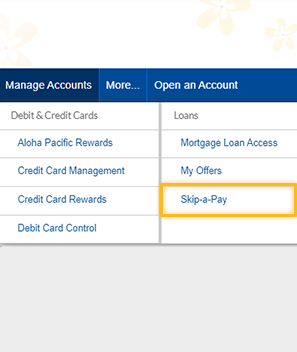

Hover over the ‘Manage Accounts’ menu, then click on Skip-a-Pay in the Loans category.

Step Three

Select an eligible loan to skip a payment and an account to deduct the processing fee from. You must read the Terms & Conditions, then click to continue.

Step Four

Review the details, then click Continue to process your skip. You can choose to print or e-mail a copy of the confirmation.

Skip a payment through our Mobile App

Step One

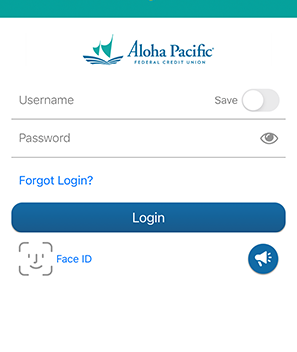

Open the APFCU Mobile App login

using your preferred method: Face ID, Fingerprint/Touch ID, or credentials (username/password).

Step Two

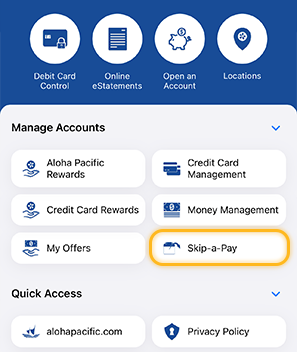

From the menu bar, tap on “More…,” then on Skip-a-Pay under the Manage Accounts group.

Step Three

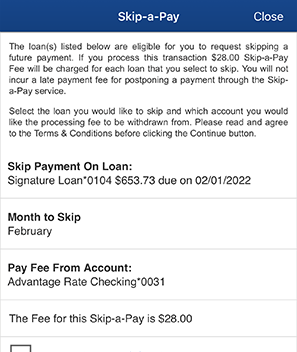

Select an eligible loan to skip a payment and an account to deduct the processing fee from.

You must read the Terms & Conditions, then click to continue.

Step Four

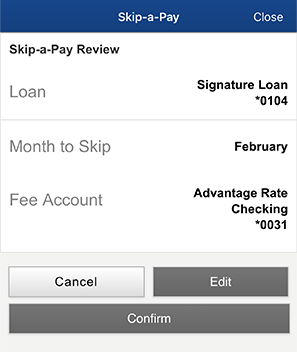

Review the details, then click Continue to process your skip. You can choose to print or e-mail a copy of the confirmation.

If you’ve set up any automatic or recurring payment transfers, you will need to cancel them for the month you have elected to skip a loan payment.

You can use Skip-a-Pay to skip an upcoming Personal closed-end loan. This service is not available for a personal line of credit, Home Equity Line of Credit (HELOC), mortgage or loans under a previous payment arrangement plan. Eligible loans must be opened for at least six (6) months and all accounts – including other loans – at the credit union must be in good standing.

Yes, a nonrefundable $28 processing fee is deducted for each skipped loan payment at the time of processing.

Unfortunately, the processing fee is nonrefundable, and a skip cannot be reversed. You may choose to make a loan payment after completing a skipped payment.

Please ensure any scheduled automatic or recurring payments are canceled for the month you have processed a skip. Otherwise, these payments will be applied towards the balance of your loan even if you’ve elected to skip.

Your Debt Protection premium will not be due at the time you processed the skip but will still be added to the balance of the loan.

Using Skip-a-Pay to defer a regular monthly payment may reduce your benefit. For more information, please review the Guaranteed Asset Protection (GAP) coverage with your provider.

Need Assistance?

For more information about the Skip-a-Pay service, you can review our guidelines above.

If you have questions or need assistance processing a skip, please contact us.